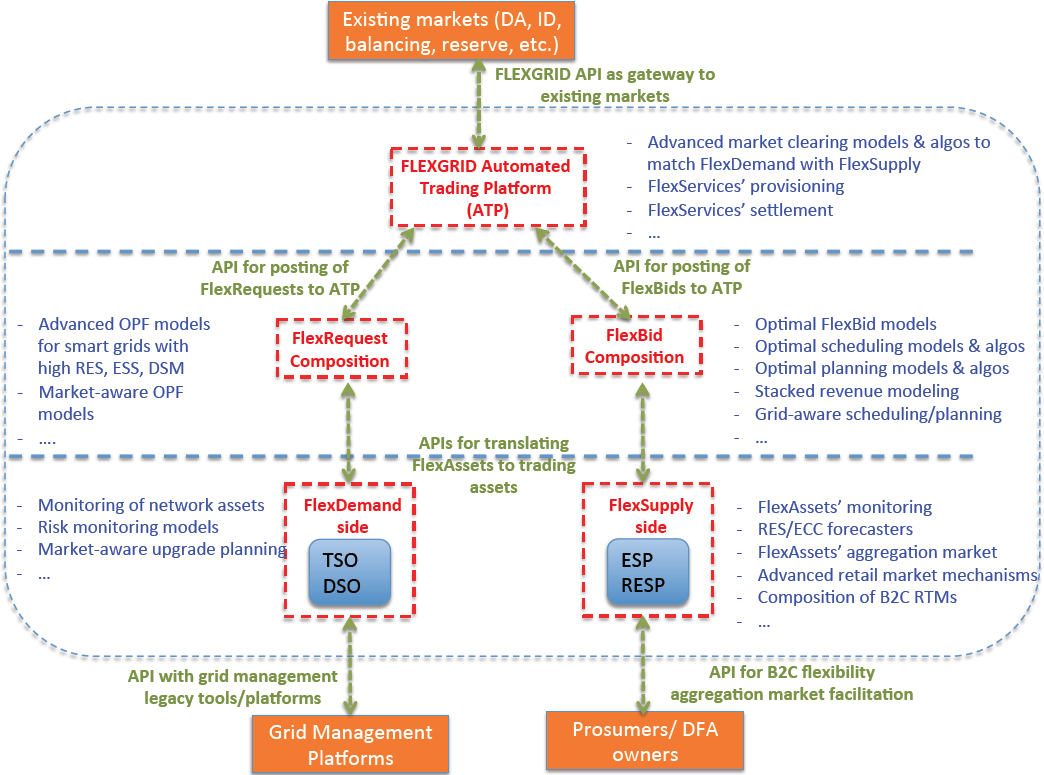

Architecture

The figure below illustrates the hierarchical FLEXGRID framework. It consists of 3 main layers. At the lower layer, all FlexAssets and electricity grid assets are monitored at both FlexSupply and FlexDemand sides respectively. In the middle layer, each stakeholder makes use of FLEXGRID’s models, algorithms and S/W tools in order to manage the operation and planning of the FlexAssets.

In other words, FlexAssets are being automatically ransformed into trading assets, thus composing FlexRequests (for FlexBuyers like DSO/TSO) and FlexBids (for FlexProviders like ESP/RESP). Finally, in the upper layer, the various individual S/W tools from the middle layer interact towards the efficient trading of FlexAssets through FLEXGRID’s Automated Trading Platform (ATP). Hence, FlexAssets are transformed into FlexServices and B2B partnerships are facilitated through the use of ATP. Multiple well-designed APIs facilitate the efficient interaction among any combination of S/W components.

In order to implement the aforementioned process, FLEXGRID will exploit and build on the following existing smart grid architectures and S/W platforms developed in ongoing or recently finished HORIZON2020 projects.

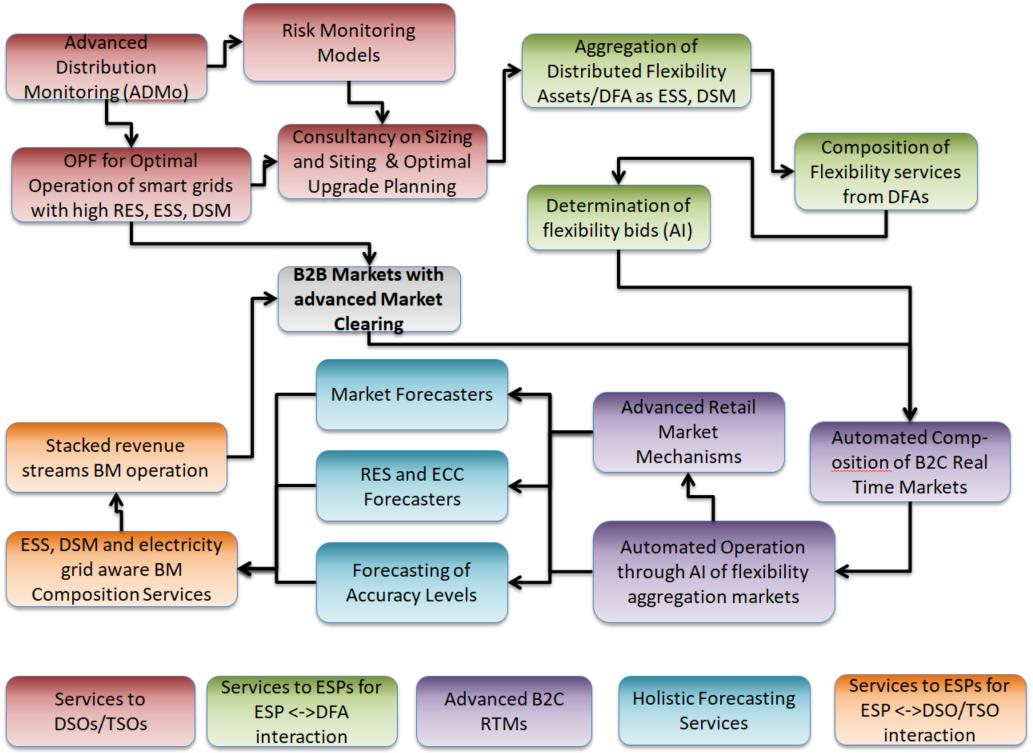

In order to implement these services, FLEXGRID will develop the necessary mathematical models and algorithms towards:

-

Advanced Distribution Monitoring (ADMo), able to follow the time-varying dynamics (RES Production, ESS use and DSM) that smart grids experience at a minimum cost.

- Risk Monitoring Models, able to:

-

quantify and derive dynamically the robustness level and the fault tolerance of Distribution and Transmission Networks and

-

express this quantified risk as a cost function that can be incorporated in the innovative pricing structures and markets proposed by FLEXGRID.

-

-

Dynamic “market consultancy” services on sizing and siting (placement) offered to RES and ESS owners, able to exploit information relevant to the electricity grid’s topology and state, in order to render them more competitive (keeping also in mind that in many countries grid topology is not a decisive factor for connecting RES and that subsidy schemes create major market distortions).

-

Optimal market power mitigation aware Upgrade Planning algorithms, able to model and quantify the relationship between the CAPEX requirements for an investment and/or upgrade in the electricity grid and the OPEX reduction (flexibility bid requests as analysed in Section 1.3.2.3) that these modifications and upgrades will bring about.

- Optimal Operation of smart grids with high RES, ESS and DSM penetration, by constituting Optimal Power Flow Algorithms more accurate, robust and scalable.

In order to conduct all the critical research towards the development of its Automated Trading Platform (ATP), FLEXGRID will develop and offer to MOs:

-

Automated Composition of Real Time Market (RTM) architectures, which electricity grid or market operators will be able to instantiate and configure, by determining the trade-off among the different market requirements (e.g. level of privacy, level of dynamicity, level of security, etc.).

-

Innovative Market Clearing Algorithms for B2B markets that exploit more advanced electricity grid models to be developed within FLEXGRID that will allow the markets to operate in a larger area of the electricity grid’s state space. This gives more freedom to the market and consequently ESs with lower cost.

- A meta-service able to transform:

- Flexibility assets (e.g., ESS, EVs, load shifts and curtailments, etc.) into Flexibility offers in these RTMs, and

- Risk Monitoring Models into Flexibility bids.

In this way, FLEXGRID develops an innovative trading data model that will act as a “trading language” for the participation of stakeholders who may lack the related technical expertise.

- Advanced Retail Market Mechanisms towards retail pricing services (B2C)

that will:

-

reflect the dynamic wholesale market prices onto the end users’ payments and

-

be able to harmonize very dynamically end-user consumption patterns with frequency and voltage control dynamic requirements that are indirectly communicated to them through FLEXGRID’s B2B real time markets.

-

-

Automated Operation of RTM through advanced trading services, which is the core of FLEXGRID and refers to the model of the trading process itself, and include: timing, automation, and security preservation of each FLEXGRID transaction. FLEXGRID will pay special attention to the development of models that capture the interaction between advanced trading schemes (e.g., P2P trading through blockchain) and electricity grid cost and constraints.

- Sophisticated Application Programming Interfaces (APIs), which will facilitate the high modularity, openness, multi-sidedness, configurability, replicability and extensibility of FLEXGRID’s services, and the platform’s adoption by the energy community.

Date: September 26, 2022

Date: September 26, 2022 H2020 FLEXGRID’s vision (https://flexgrid-project.eu/) is to bridge the

gap between reliable grid operation and flexibility market efficiency by

developing a...

H2020 FLEXGRID’s vision (https://flexgrid-project.eu/) is to bridge the

gap between reliable grid operation and flexibility market efficiency by

developing a...