Value propositions

We consider the following 3 value propositions (or else business cases) for FLEXGRID’s S/W platform’s commercial exploitation, namely:

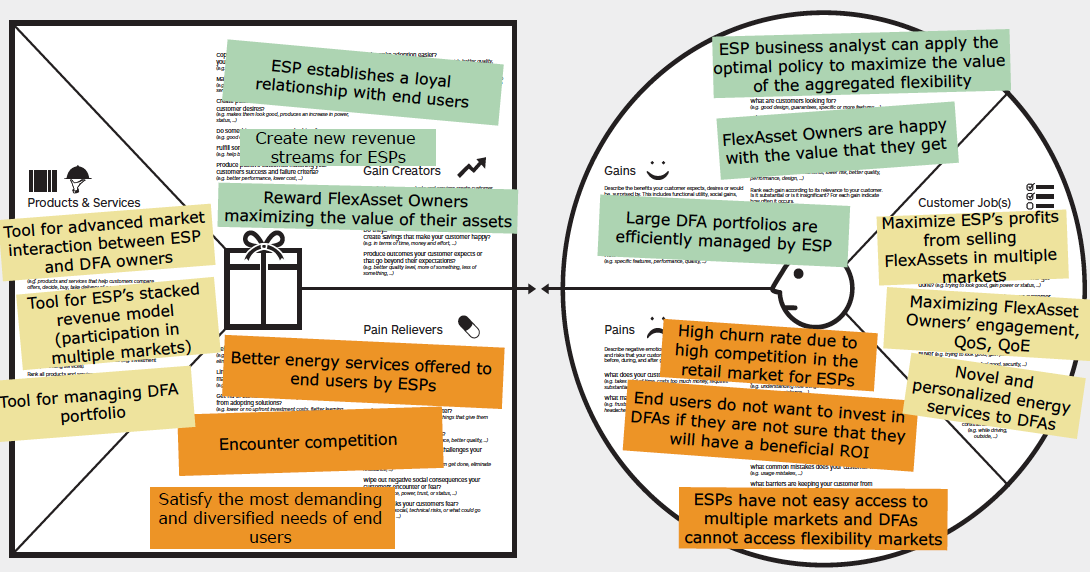

Value proposition 1: Flexibility aggregation for ESP’s participation in multiple energy markets and novel FlexPrograms offered by the ESP to small-scale Distributed Flexibility Asset (DFA) owners

This business case deals with the aggregation of many small-scale DFA owners (or else prosumers).

This task is performed by an ESP, who will then is able to optimally decide how to trade this DFA owners’ aggregated flexibility in multiple energy markets such as day-ahead, intra-day, balancing, etc. FLEXGRID provides a tool for advanced B2C market interaction (between the ESP and DFA owners). The latter are able to make their bids according to the way they perceive the trade-off between their electricity bill reduction and inconvenience incurred by load cuts/shifts and battery charge/discharge.

As a result, the ESP will optimally schedule the energy prosumption of all DFA owners trying to both maximize the ESP profits and end users’ welfare (i.e. system’s social welfare). ESP profits are maximized by optimally placing flexibility bids in various markets. End users’ welfare is maximized by finding an optimal trade-off between electricity bill reduction and increased inconvenience. ESP will offer novel FlexPrograms to end users that best fit each one’s personalized energy prosumption profile. Leaders of this value proposition are NPC (together with its linked 3 rd party Nord Pool) and UCY (in cooperation with Electricity Authority of Cyprus), while academic partners ICCS/NTUA and UNIZG-FER will be involved in the related research tasks.

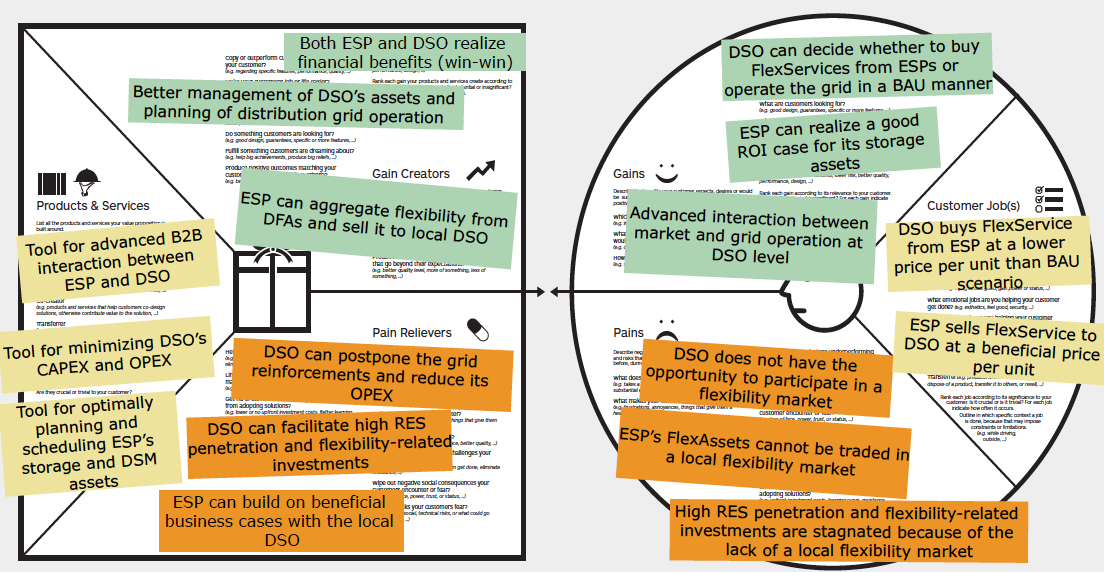

Value proposition 2: Interaction between ESPs and DSO(s) (e.g.congestion management and voltage control services realization through B2B flexibility market)

This business case deals with the advanced B2B interaction between a DSO and one or more ESP’s. FLEXGRID provides a tool for optimally planning and scheduling ESP’s storage and DSM assets taking into consideration the technical constraints imposed by the distribution grid operation through a market that allows DSO to acquire flexibility. Thus, FLEXGRID provides a tool for minimizing DSO’s CAPEX and OPEX by optimally exploiting the flexibility offered by the ESP(s). So far, there is no market for the trading of flexibility at the distribution grid level. FLEXGRID aims to design such an integrated marketplace. The use cases of load and production driven congestion management via the NODES flexibility marketplace have already been tested successfully in installations in Norway and Germany respectively.

bnNETZE will lead requirements analysis and trails in this task. Through interaction with its existing commercial relationships with DSO(s), bnNETZE will test different BMs for ESP-DSO interaction. In the Figure below are illustrated the “pains and gains” for each one of the two involved stakeholders. Leaders of this value proposition are bnNETZE (in cooperation with its subsidiary DSO bn-Netze) and NODES, while AIT will be in charge of performing emulation and validation tests for voltage control issues (i.e. TRL 5). Academic partners DTU, SIN, ICCS/NTUA and UCY will be involved in the related research tasks.

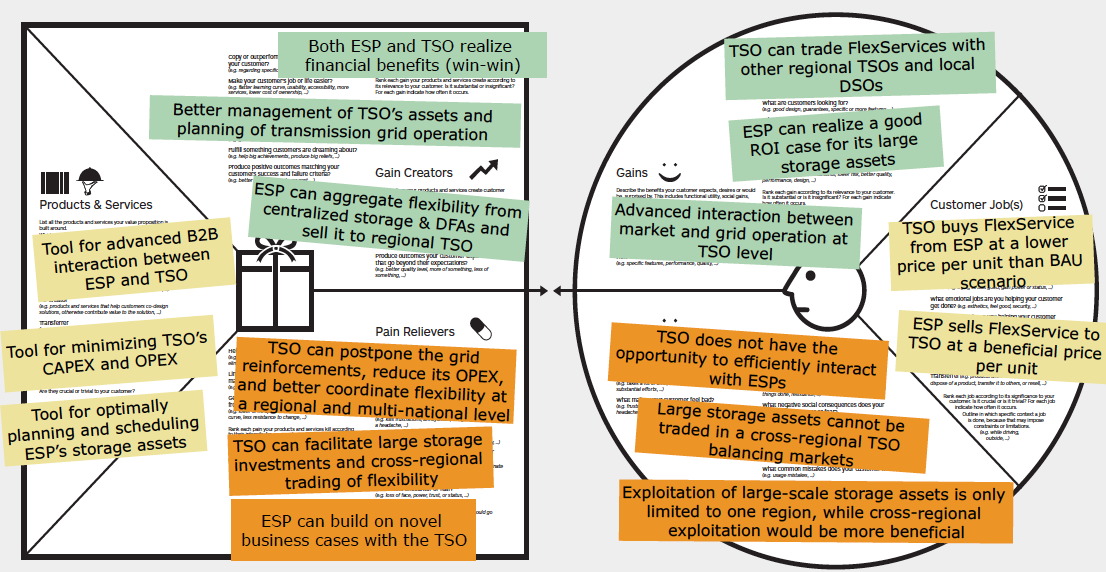

Value proposition 3: Interaction between large ESPs and TSO(s) (e.g. balancing and frequency control services realization through B2B flexibility market)

This business case is similar with the previous one, but on the transmission grid level. FLEXGRID provides a tool for advanced B2B interaction between one or more large-scale ESS and/or DSM companies (i.e. ESP), which offers services to a TSO. The ESP will be able to use a FLEXGRID’s intelligence to optimally plan and schedule its large-scale flexibility assets. On the other hand, the TSO will be able to minimize its CAPEX/OPEX, through FLEXGRID’s services (it will also be able to possibly use this flexibility in cooperation with another TSO of another region/country). Advanced market architectures and market clearing processes will enable an efficient interaction.

Therefore, FLEXGRID will function as a gateway to the existing, central markets, when value is higher than at the local DSO market. For example, when flexibility is activated locally, the FlexSupplier (i.e. ESP) may be exposed to an imbalance. This imbalance could be solved through a simultaneous trade in the intra-day market via FLEXGRID. Alternatively, the FlexSupplier could do the re-balancing through its own portfolio through self-balancing by harnessing more flexibility from the end prosumers. All these options will be available at FLEXGRID platform. WEMAG (which is an ESP that already has commercial relationships with TSOs) will be the industrial partner responsible for the requirements analysis of this value proposition while HOPS will be responsible for the TSO’s requirements analysis. NPC is will analyze the balancing market operation and AIT is in charge of performing emulation testing and validation for frequency control services.

Date: September 26, 2022

Date: September 26, 2022 H2020 FLEXGRID’s vision (https://flexgrid-project.eu/) is to bridge the

gap between reliable grid operation and flexibility market efficiency by

developing a...

H2020 FLEXGRID’s vision (https://flexgrid-project.eu/) is to bridge the

gap between reliable grid operation and flexibility market efficiency by

developing a...