Business Models

FLEXGRID envisages a distributed flexibility marketplace, where FlexAssets will be traded between FlexSuppliers and FlexBuyers through an Automated Trading S/W Platform (ATP). In full market operation, FLEXGRID ATP should be independent of any participating market party (i.e., ESP, TSO/DSO, traditional MO, aggregator, etc.) or else no market stakeholder or grid owner can be a major owner of FLEXGRID marketplace.

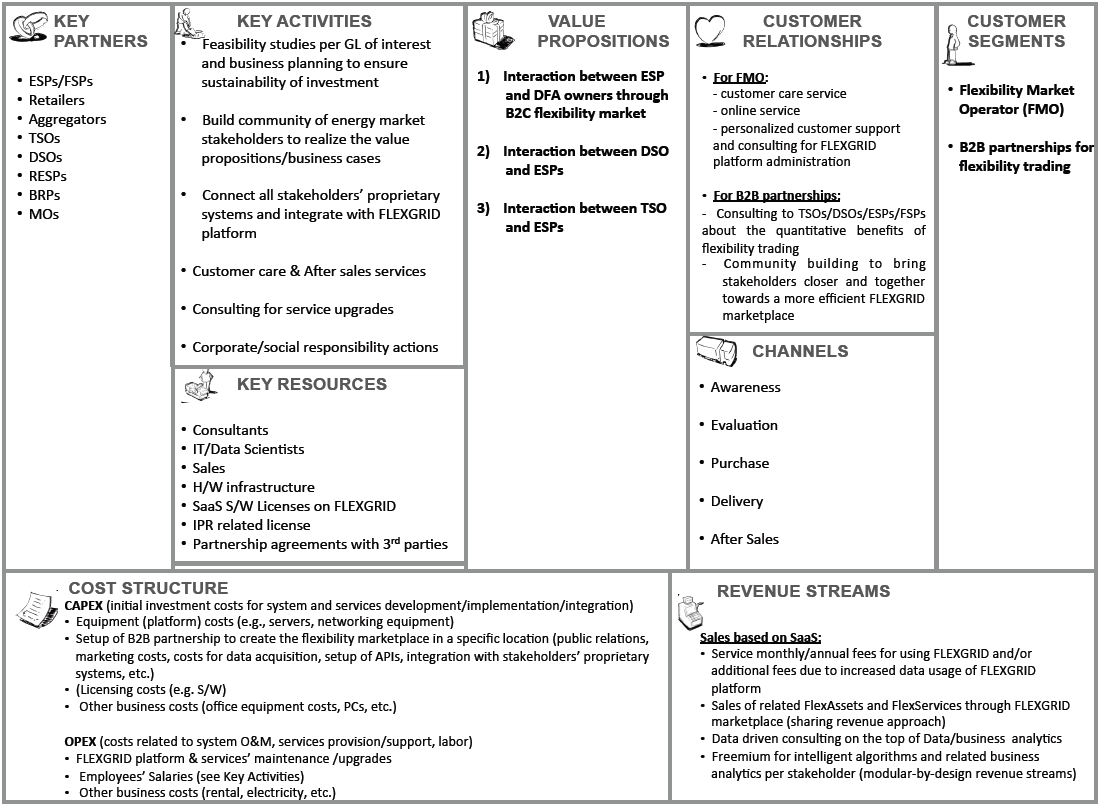

So, the customer of FLEXGRID platform (as a whole) will be a novel market actor called Flexibility Market Operator (FMO), such as NODES. In addition, following up the business modeling of NODES, B2B partnerships need to exist in order for various business cases (or else value propositions) to be realized.

The most important prerequisite to make FLEXGRID’s business plan sustainable is to able to produce financial benefits and better market position for ALL involved stakeholders compared to the Business As Usual (BAU) scenario, including the FLEXGRID platform’s revenues. Based on the Business Model Canvas shown in the Figure above, the FLEXGRID consortium focuses on 3 specific value propositions and respective B2B partnerships that heavily interest the FLEXGRID’s industrial partners (i.e. NPC, NODES, WEMAG, bnNETZE, HOPS and EAC).

Date: September 26, 2022

Date: September 26, 2022 H2020 FLEXGRID’s vision (https://flexgrid-project.eu/) is to bridge the

gap between reliable grid operation and flexibility market efficiency by

developing a...

H2020 FLEXGRID’s vision (https://flexgrid-project.eu/) is to bridge the

gap between reliable grid operation and flexibility market efficiency by

developing a...