Impact

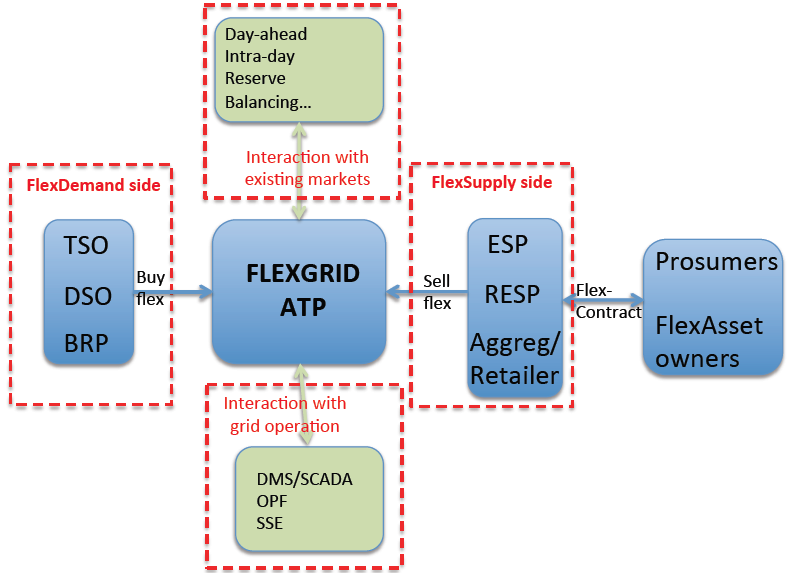

The figure above illustrates a high-level description of FLEXGRID’s market design, including the roles of each participating stakeholder. On the left side are shown those who buy flexibility: TSOs and DSOs. In addition, Balance Responsible Parties (BRPs) might re-trade committed flexibility with other BRPs that offer cheaper flexibility. These buyers will have to define their willingness to pay for activation of flexibility at particular Geographical Locations (GLs) and feed this information, in the form of FlexOffers/FlexRequests, continuously into FLEXGRID via an API. The flexibility is made available by the flexibility providers on the FlexSupply side, who will act on behalf of the owners of the FlexAssets and feed these FlexBids into FLEXGRID via another API.

There is one basic type of FlexBid (supply side) and FlexOffer (demand side). However, this is slightly different and can be dynamically parameterized according to the business case under consideration. The next step will be for the FLEXGRID Automated Trading Platform (ATP) to match FlexDemand with FlexSupply, thus clearing the ad-hoc flexibility market, and define the FlexPrice according to the FlexAssets to be traded. The FLEXGRID ATP will also be able to interact with the existing energy markets (day-ahead, intra-day, reserve, balancing, etc), making platform’s flexibility available to these markets, too.

This means that flexibility sellers can also differentiate their FlexBids depending on whether the FlexAssets are sold locally or centrally. Selling locally, at a specific location, can in many cases be riskier, as there are fewer alternatives in case the seller needs to rebalance due to unforeseen unavailability of some FlexAssets. In contrast, contractual positions in the intra-day market are much easier to rebalance, but the FlexPrice is expected to be much lower. The proposed FlexBid structure will be complex/rich enough to define several portfolios within each GL and differentiate the price and other properties [ramping capability (max/min), source, production, consumption, max/min activation time, max/min activation duration etc].

DSOs might in some cases prefer increased consumption instead of ramping down RES. TSOs might have preferences to activation time and ramping when products are sold in their balancing markets. FLEXGRID ATP will have filters that flexibility buyers can use when they optimize their grid costs according to their actual need of flexibility quality. Thus, interaction with grid operation will be facilitated through an API, which will communicate in an intelligent manner all the network-related constraints. Finally, the sellers of flexibility (ESPs, flexibility aggregators) will need to have a business model with the FlexAsset owners and/or their clients (prosumers) in the form of FlexContracts, and the technology that activates the flexibility by those who have bought it.

FlexContracts will define the exact way that end prosumers will be compensated in exchange of offering their flexibility. Each end prosumer evaluates in a different way the trade-off between the electricity bill’s reduction and the incurred inconvenience. This trade-off is mathematically represented by FlexAssets’ cost function. Thus, advanced pricing algorithms will reside at the ESP’s side in order to clear the internal market between the ESP and its end prosumers/FlexAsset owners.

Date: September 26, 2022

Date: September 26, 2022 H2020 FLEXGRID’s vision (https://flexgrid-project.eu/) is to bridge the

gap between reliable grid operation and flexibility market efficiency by

developing a...

H2020 FLEXGRID’s vision (https://flexgrid-project.eu/) is to bridge the

gap between reliable grid operation and flexibility market efficiency by

developing a...